Today, I want to talk about something a bit off the beaten path but incredibly useful for those of us in the street food vending business: tax exemptions.

Specifically, using a religious exemption or tax exemption type deal under the religious codes and freedoms that are given to religious organizations.

This can be a game-changer for hot dog vendors and other small business owners looking to save some bucks.

What Is Tax Exemption?

First off, let’s clear the air about what tax exemption is.

In short, it’s a status that allows an organization or individual to be free from paying certain taxes.

In the United States, religious organizations often benefit from such exemptions, allowing them to operate without the burden of income tax and sometimes even property tax.

The Power of Religious Exemptions

Even the smallest of religious organizations can benefit from these tax exemptions.

You might be thinking, “Ben, how is this even possible?”

Well, let me tell you, it is.

If you don’t believe me, just watch John Oliver’s segment on the “Church of Perpetual Exemption.”

He created a church just to show how easy it is to become tax-exempt.

Your income becomes non-taxable, and the church can pay for everything: your home, your car, and other personal expenses.

This includes the bills of the preacher, the assistant pastor, and more.

The best part?

It doesn’t have to be a traditional church.

It could be the “Church of the Quarter Pound Hot Dog” if you want!

(Helpful Read: Hot Dog Vending Using Donation Only – No License)

How to Get Started

Before you get too excited, let’s cover the basics.

Here’s how you can start your own tax-exempt religious organization:

Step 1: Research and Understand IRS Guidelines

The IRS has clear guidelines on what qualifies as a religious organization.

You don’t have to apply for a 501(c)(3) status, but you do need to meet specific criteria.

You can find this information on the IRS website.

Step 2: Establish Your Church

Come up with a name and purpose for your church.

Believe it or not, there are churches for almost everything—there’s even a Church of the Flying Spaghetti Monster!

STARTING ON A BUDGET? »» CLICK To Learn More

Start your own street food business with a small investment – [CLICK HERE]Step 3: Apply for Tax Exemption

Once you meet the guidelines, you can declare your organization as tax-exempt.

No need for extensive paperwork.

Just meet the requirements, and you’re good to go.

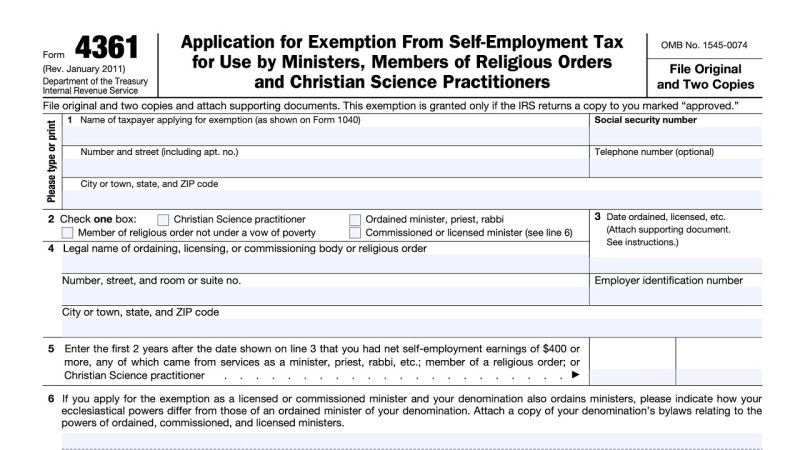

Step 4: Use Form 4361

The IRS Form 4361 exempts you as the church pastor from paying personal taxes.

This form is crucial for enjoying the full benefits of your tax-exempt status.

Is This Moral?

Now, you might be wondering, “Is this moral?”

That’s a personal question and depends on your perspective.

Many large churches and religious organizations use these exemptions to their advantage.

They own properties, businesses, and even malls, all while avoiding taxes.

Helpful: Most Street Food Vendors Are Overpaying Sales Tax (Here’s How to Fix It)

The Legal Loopholes

Tax Exemption Without 501(c)(3)

One of the biggest benefits is that you don’t need a 501(c)(3) status to be considered tax-exempt.

If you meet the IRS guidelines, you’re already good to go.

Employee Tax Exemption

Did you know that as a minister or assistant pastor of your church, you can apply for a tax exemption on your personal income?

That’s right, and it’s entirely legal.

The Bigger Picture

These exemptions exist because America values religious freedom and offers these benefits to religious organizations.

If you’re interested in taking this route, it could mean significant savings and operational benefits for your hot dog vending business.

Final Thoughts

I’m not an accountant, bookkeeper, or lawyer, so I highly recommend doing your own research or consulting with a professional.

(Helpful Read: How to Calculate Sales Tax the Easy Way)

However, the potential benefits of running your hot dog vending business through a tax-exempt religious organization are substantial.

It’s a legal, 100% above-board way to save money and grow your business.

I hope this inspires you in some way, shape, or form.

Remember, there are many paths to success in this business.

Explore your options, do your homework, and make the best decision for you and your business.

And if you want to take your vending business to the next level, go and get together with the best vendors on the planet inside the Vendors United community.

You can learn about it HERE (it is 100% free to try it out for 5 days!!)…

🧡🧡 Vendors United – 100% FREE 5 Days Trial – Try It Today! 🧡🧡

I love you, and I’ll talk to you soon.

Bye!

FREE HELP VIDEOS! »» CLICK For Free TEXT Notifications

DONE FOR YOU!! - I'm excited about it after years of folks requesting it. It's 100% free for you. I go live on YouTube a lot. And some want to be notified moments before I do. If you do... then get on the list here...[Ben's going LIVE list]

HELPFUL RESOURCES...

MY COURSE BOOK - Everything you need to know about getting started, my journey, my secrets...all the goodies that changed my life, and how it was done -[CLICK HERE]

HOW TO GET THE BEST LOCATION FOR YOUR CART! - How To Get Any Location You Want - The "Most Wanted Secret" Any Vendor Wants To Know! -[CLICK HERE]

FREE BOTTLED WATER HACK! - Apply a couple little tricks, get free water, sell it for whatever you want and keep all the money! -[CLICK HERE]

HOW TO GRILL, STEAM & BOIL LIKE A PRO! - Get "STEAM, BOIL & GRILL" Now and learn Live from a Pro! -[CLICK HERE]

BUILD YOUR OWN CART - From home, saving a bunch of money. Easy way to get started - [CLICK HERE]

HOW TO START ON A BUDGET - Start your own street food business with a small investment - [CLICK HERE]

ALREADY VENDING AND WANTING TO GROW? - I have created a training wizard that can help you concur any part of the business you want. No matter the state you're in...no matter if you're brand new or have already gotten started - [CLICK HERE]